A beautifully presented one bedroom top floor apartment for the over 55's within this very conveniently located City centre development. Shops, cafes and restaurants as well as Doctors surgeries and all other amenities are close at hand. Davis Court also benefits from a residential manager, 24 hour emergency monitoring system, organised events in the communal lounge, guest accommodation for friends and relatives, residents parking and a long lease. Offered for sale chain free.

Entryphone system. Lifts to upper floors.

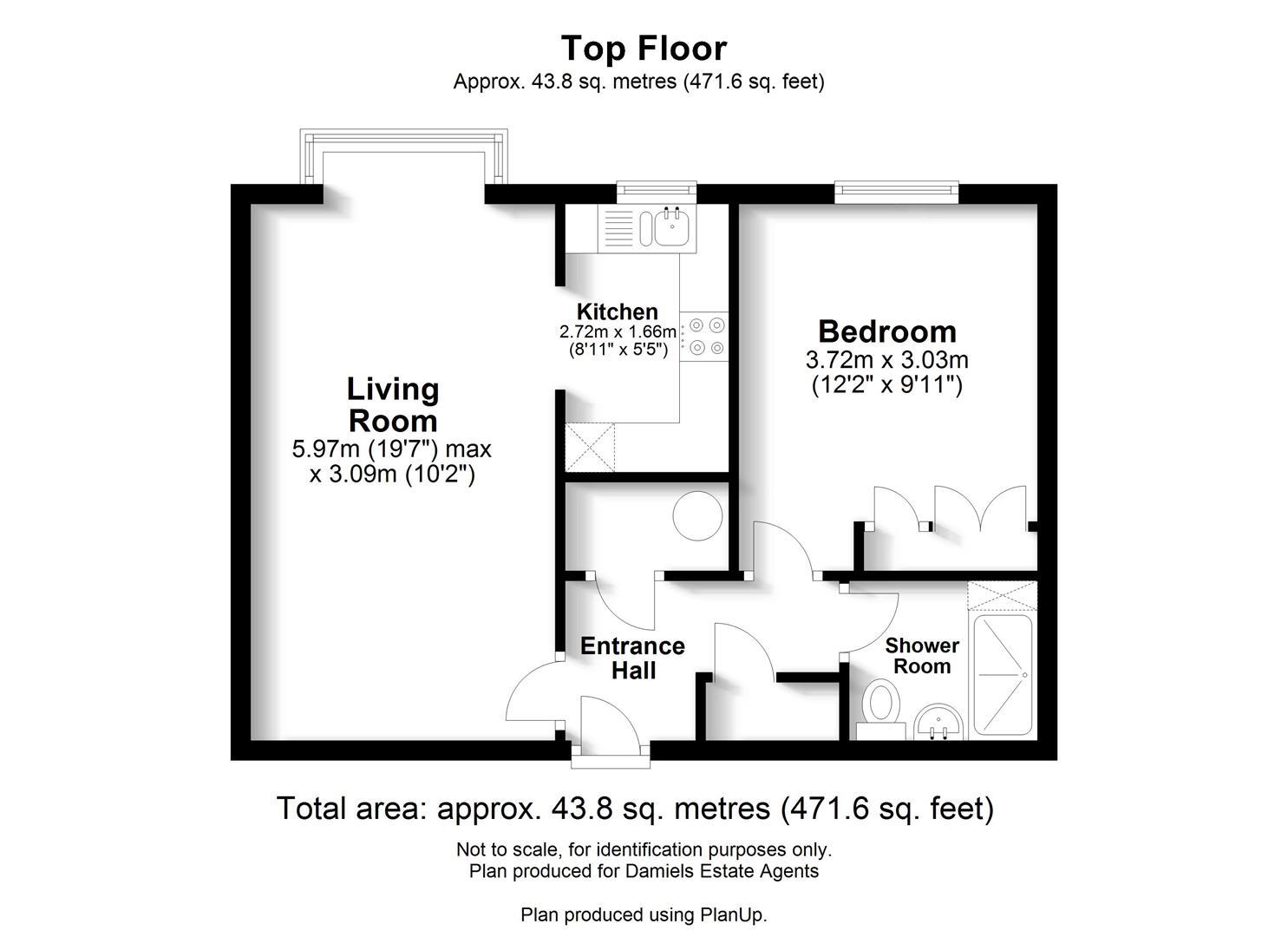

Coved ceiling. Airing cupboard housing hot water system. Additional storage cupboard. Electric heater. Doors to:-

Double glazed window to rear. Coved ceiling. Entry phone system. Electric heater. Archway leading to:-

A modern refitted kitchen with a range of wall and base mounted units with roll top work surfaces. Inset stainless steel sink unit with drainer and tiled splash backs. Integrated oven with extractor fan over. Space for fridge/freezer. Plumbing for washing machine. Double glazed to rear. Non slip vinyl flooring.

Double glazed window to rear. Coved ceiling. A rang of fitted wardrobes. Electric heater.

Double shower enclosure. Pedestal wash hand basin. Low level WC. Electric heater. Wall mirror. Built in storage.

Large communal Lounge area hosting various social events detailed on the notice boards. Communal games room. Two communal drying rooms.

Allocated and visitors parking. Well maintained communal gardens.

155 years remaining

£674.95 per quarter to include 24 hour monitoring service.

Residents parking

Long lease

Communal lounges

Drying room

Emergency pull cords

Resident manager

Living Room

Guest accommodation for friends and relatives

Re-fitted Kitchen

Modern shower Room